Apprenticeship tax balance: changes for 2023

In 2022, for the last time, your company had the opportunity to pay its balance of the apprenticeship tax to one of our schools. From 2023 onwards, URSSAF will collect this 13% balance directly from you.

Today, with the payment of the apprenticeship tax, you have the power to participate in the training of our students, who will become the actors of your success!

For more information, do not hesitate to contact us by email : taxe-apprentissage@omneseducation.com

Qu’est que la taxe d’apprentissage? Tout savoir sur le sujet en quelques minutes !

Choisissez d’investir dans l’avenir !

Why should I pay the remaining 13% of the apprenticeship tax to OMNES Education Group Schools?

3 good reasons to support with your donations, the success of OUR students, YOUR future talents:

How does the apprenticeship tax contribute to the expertise of our teaching?

The money collected from the apprenticeship tax contributes to the development of student education, with concrete results! It allows our schools to create new programs, hire new lecturers, develop international opportunities, deploy the latest digital tools, and organize symposiums, conferences and seminars.

The apprenticeship tax is not only a tax story…

…it’s also a story of partnership between you and our schools. Support the schools of the OMNES Education Group, and invest in the continuous improvement of the quality of our training, and in the employability of our students. This is an opportunity for us to develop a privileged relationship with you, so that our training courses best meet your needs.

OMNES Education: agility and innovation

Two strong values carried by our schools. This translates into a permanent watch on new technologies, on your expectations and on the needs of our students. OMNES Education is an inclusive institution by opening its doors and accompanying all profiles, regardless of their educational or social background. This contribution to the apprenticeship tax allows us to support our students in the construction of their professional project.

OMNES Education intends to strengthen its offer of multidisciplinary schools and programs, expand its pedagogical innovations and open new campuses in France and in Europe. The remaining 13% of the apprenticeship tax collected from companies contributes to the development of our mission and the training of our future graduates.

Which companies must pay the apprenticeship tax?

The apprenticeship tax is a tax due by companies* to finance the expenses necessary for the development of technological and professional training.

*Businesses of a commercial, industrial or artisanal nature and subject to Income Tax or Corporation Tax and employing at least 1 employee. Refer to the site service-public.fr

To which institution should the remaining 13% of the apprenticeship tax be paid?

Our schools authorized to collect payments from companies as of right on the balance of the apprenticeship tax are :

- INSEEC Ile-de-France UAI 0754500J

- INSEEC New Aquitaine UAI 0332524P

- INSEEC Rhône-Alpes UAI 0694282E

- ECE UAI 0754431J

How to calculate the balance of the 13% of the apprenticeship tax?

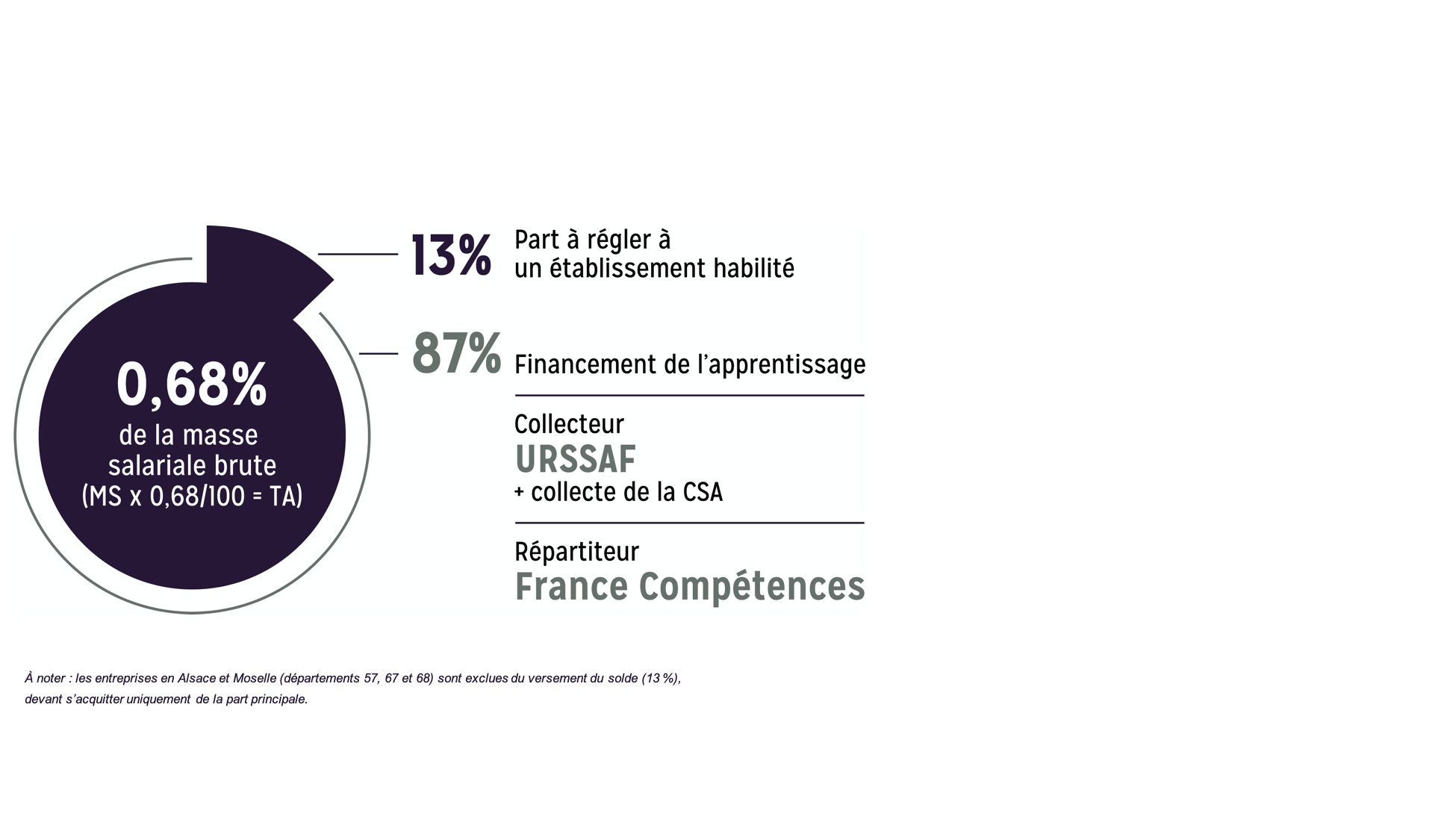

It is calculated on the basis of the amount of wages subject to social security contributions and benefits in kind paid by the company over a calendar year (bonuses, gratuities, allowances, etc.). Its rate is set at 0.68% of the total payroll.

Its distribution

It must be paid in 2 parts:

- The remainder (13%), intended for the development of initial technological and vocational training (excluding apprenticeship)

From February 2022: the employer will declare and pay this fraction to URSSAF or MSA each month in DSN, according to the same procedures as all social contributions.

- The main part (87%) is dedicated to the financing of work-study programs

The 2020 reform has changed the payment of this share, companies must pay this share directly to the institutions of their choice between JANUARY 1 and MAY 31, 2022.

What happens to the funds collected through the apprenticeship tax?

Each year, the balance of the apprenticeship tax is collected to support the development of our education system, in particular by allowing :

- The opening of new campuses;

- Recruitment of teacher-researchers;

- Pedagogical innovation;

- Expansion of asynchronous multi-topic online courses;

- The internationalization of our training;

- Financing of student projects & development of entrepreneurial projects.

How do I contact the Business Relations Department in charge of the apprenticeship tax?

Magali Parein

Fundraising Manager – Corporate Relations Department

mparein@omneseducation.com – Tel. : 01 42 09 70 63

43 Quai de Grenelle – 75015 Paris

Virginia Martin

Responsible for the apprenticeship tax

taxe-apprentissage@omneseducation.com – Tel. : 01 53 92 03 41

43 Quai de Grenelle – 75015 Paris

To go further :

How do I recruit a work-study student or an intern?

For your recruitment needs for interns, work-study students or young graduates,

you can send us your offers, or find your future talent, on our dedicated platform: